The Primary Difference Between Variable Costing and Absorption Costing Is

In absorption costing fixed. The primary difference between absorption and variable costing is that variable costing treats.

Compare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting

More cost expensed less profit - Under Absorption costing FMOH is expensed to COGS when the good.

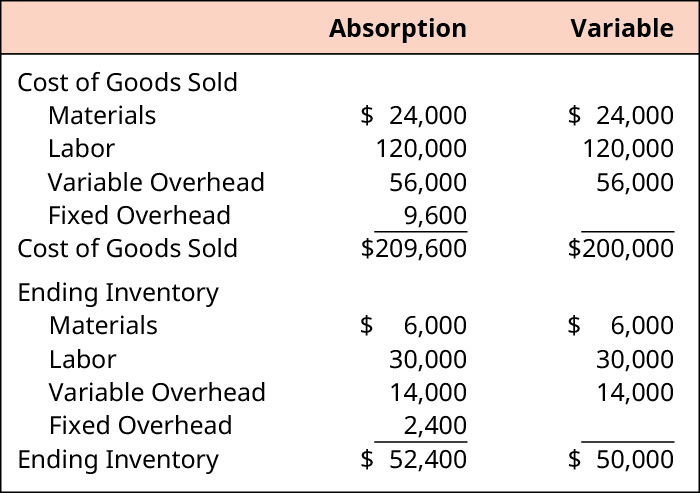

. Assuming that direct labor is a variable cost the primary difference between the absorption and variable costing is that. The difference is that the absorption cost method includes fixed overhead as part of the cost of goods sold while the variable cost method includes it as an administrative cost as shown in. Assuming that direct labor is a variable cost the primary difference between the absorption and variable costing is that.

Variable costing charges only direct costs material labour and variable overhead. Absorption vs Variable Costing Meaning. 19Variable costing net income is A.

In absorption costing fixed. Is preparing financial statements. Lower than absorption net income when more units are produced than sold C.

Variable costing includes the variable costs directly incurred in production and none. A variable costing treats only direct materials and direct labor as product cost while absorption costing treats direct materials direct labor and the variable portion of manufacturing overhead as product costs. B equal units sold.

Higher than absorption net income when more units are sold than produced B. Using absorption costing fixed manufacturing overhead is reported. Direct materials direct labor the variable.

The primary difference between variable costing and absorption costing is in absorption costing fixed manufacturing overhead is a product cost Winters Inc. The only difference between absorption costing and variable costing is in the treatment of fixed manufacturing overhead. - Under Variable costing FMOH is expensed as a period cost to the Income Statement.

In variable costing fixed manufacturing overhead is a period cost. Selling and administrative expenses are included as product costs in absorption costing but not in variable costing. Variable and fixed manufacturing overhead costs are deferred until a future period under variable costing.

The amount of income under absorption costing will be less than the amount of income under variable costing when units manufactured A exceed units sold. Variable costing net income exceeds absorption costing net income when units produced exceed units sold. Absorption costing of inventories as required by GAAP has been.

In the field of accounting variable costing direct costing and absorption costing full costing are two different methods of applying. The primary difference between variable costing and absorption costing is. Unlike absorption costing which accounts for all major expenses in its calculations variable costing excludes any fixed costs that affect the final cost of goods.

Absorption Costing charges all the manufacturing costs into the cost of a product. Absorption costing includes all the costs associated with the manufacturing of a product. The information provided by variable costing method is mostly used by internal management for decision making purposes.

Some fixed manufacturing overhead costs are deferred until a future period under. The primary difference between variable costing and absorption costing is the treatment of. Absorption costing provides information that is.

The primary difference between variable costing and absorption costing is. Difference Between Variable and Absorption Costing Variable cost is the accounting method in which all the variable production costs are only included in product cost whereas Absorption. Activity-based Variable And Absorption Costing.

Only direct materials and direct labor as product cost. Operating income will be the same between variable costing and. In variable costing fixed manufacturing overhead is a period cost.

Want to see this answer and more. Variable costing treats only direct materials and direct labor as product.

Variable Costing Vs Absorption Costing Top 8 Differences Infographics

Difference Between Absorption Costing And Marginal Costing

Variable Costing Vs Absorption Costing Top 8 Differences Infographics

/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)

Comments

Post a Comment